Goals and constraints

From a zero baseline in 2023, we were hired to turn a new Shopify store for Japanese haircare into a reliable source of organic traffic and sales across the EU. With a limited monthly budget and a narrow initial catalog, we defined a plan that balanced fast visibility wins with durable SEO foundations.

Constraints and objectives:

- Budget - 500 EUR per month across July 2023 - April 2025.

- Market constraints - limited SKU assortment due to EU documentation requirements for many product types.

- Objectives - build EU visibility for Japanese haircare queries, establish a stable organic traffic stream, and grow revenue from non-English EU markets.

Introduction

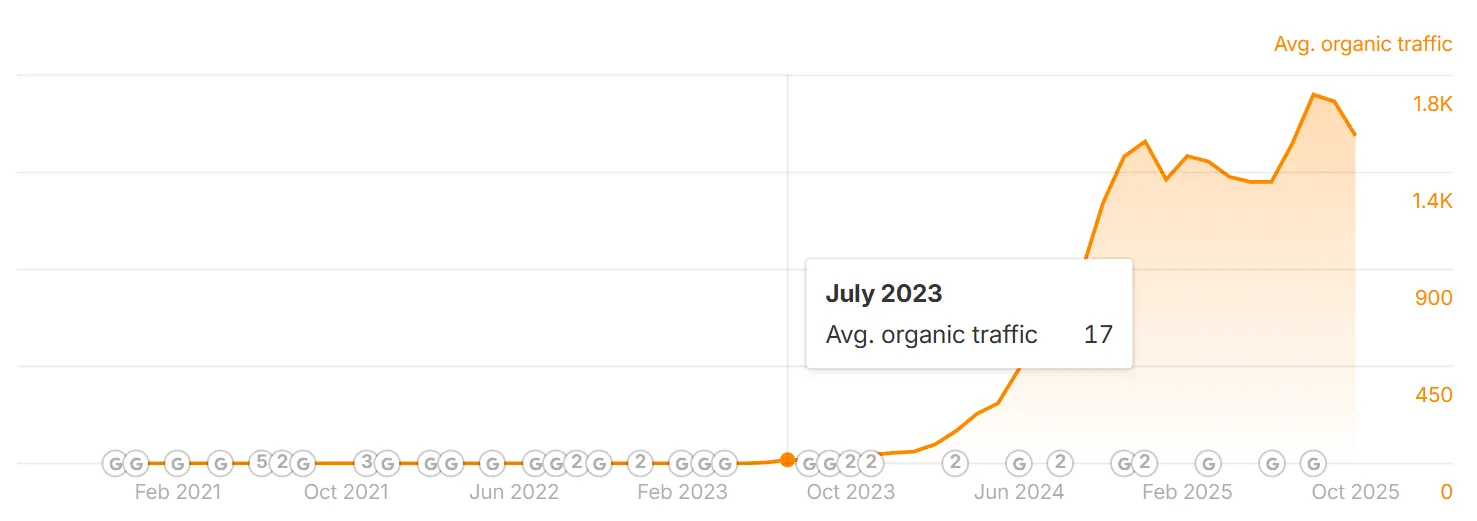

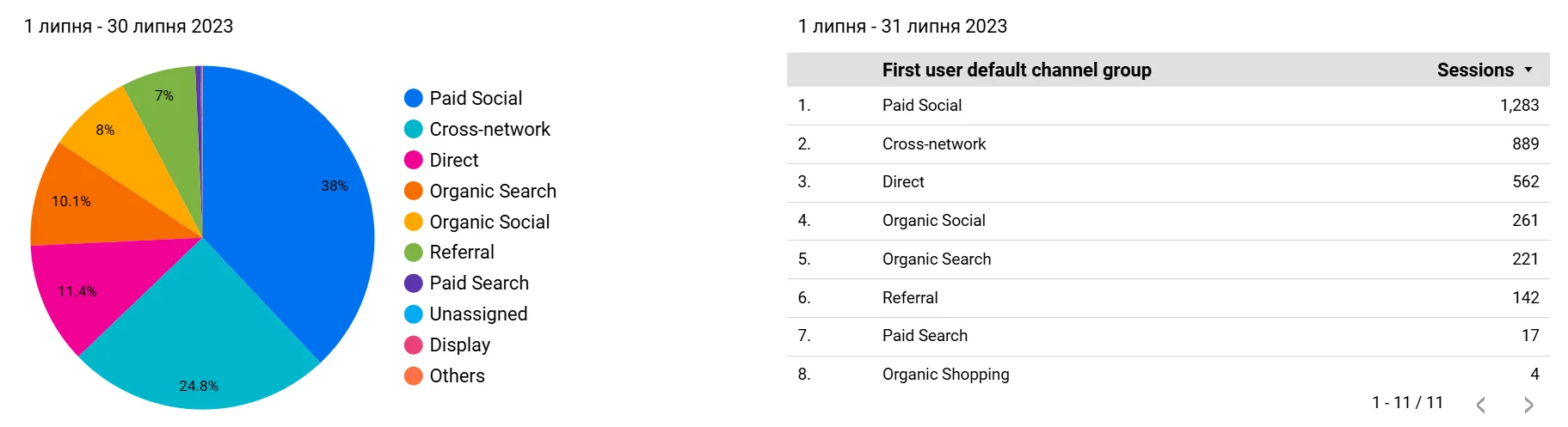

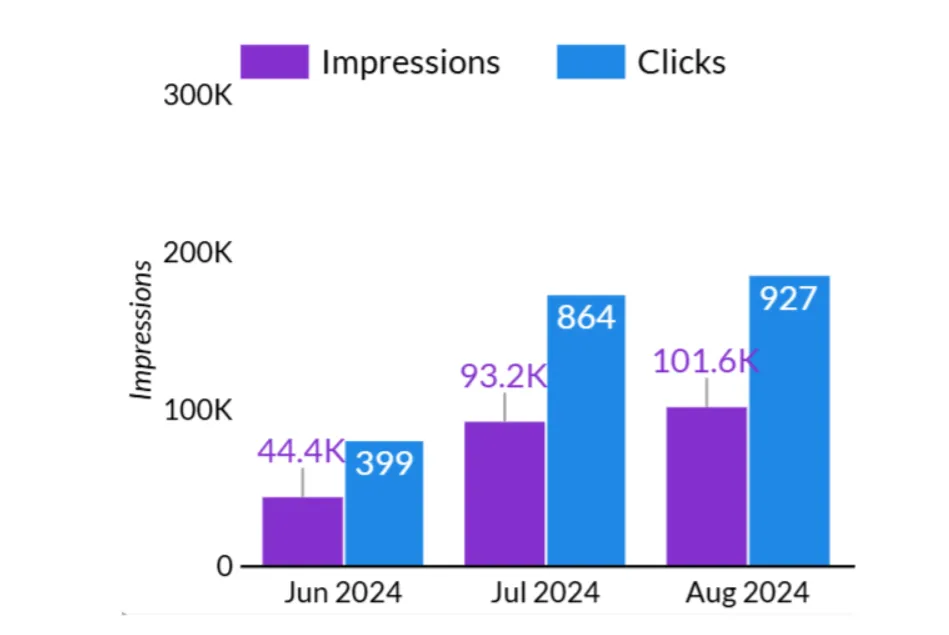

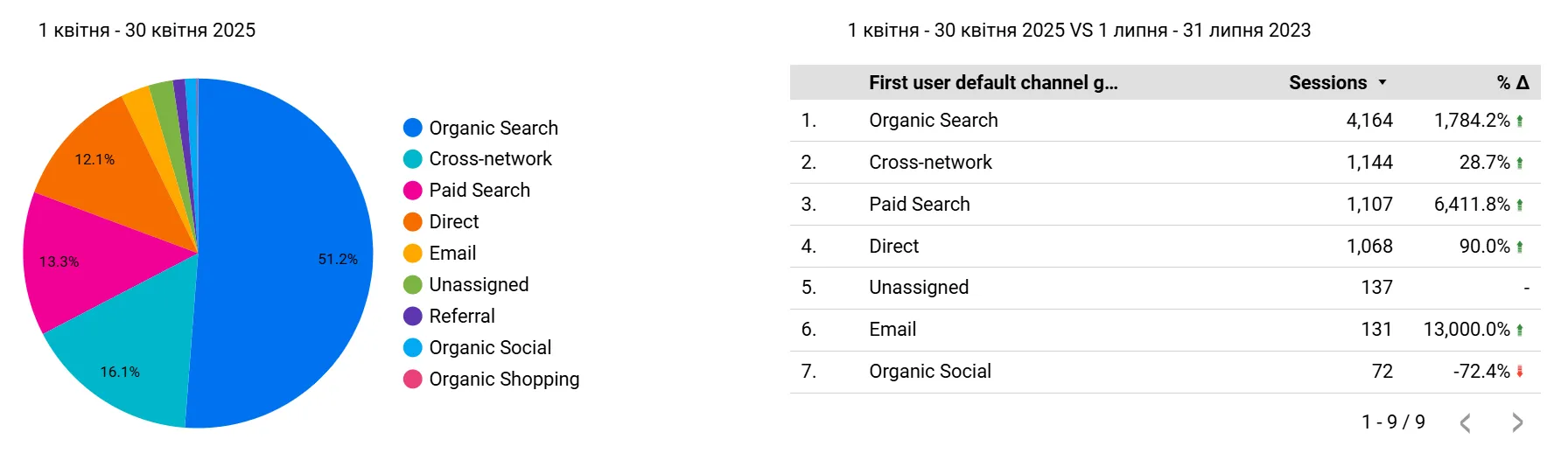

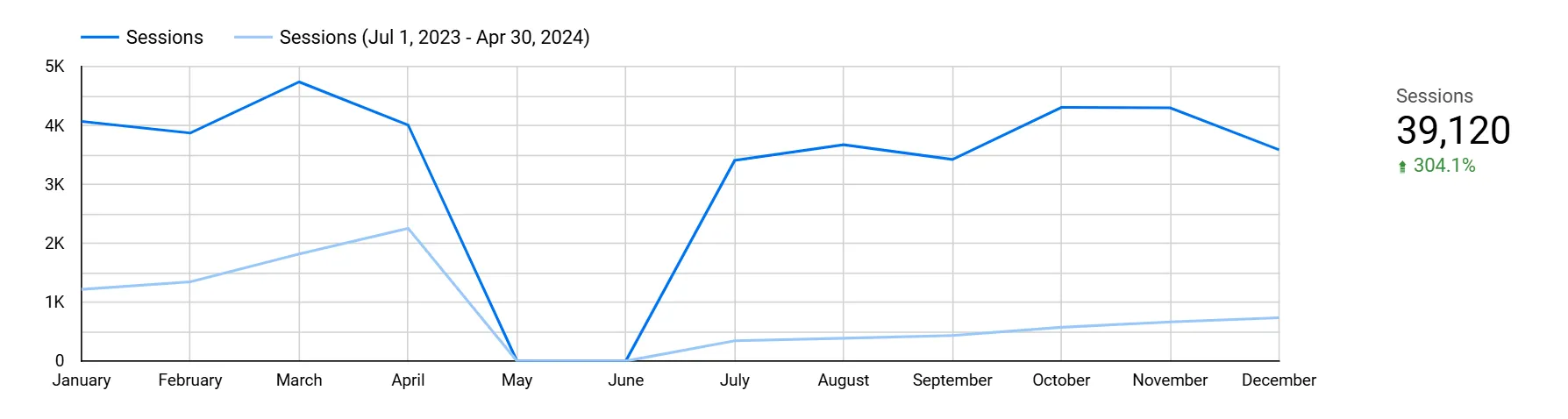

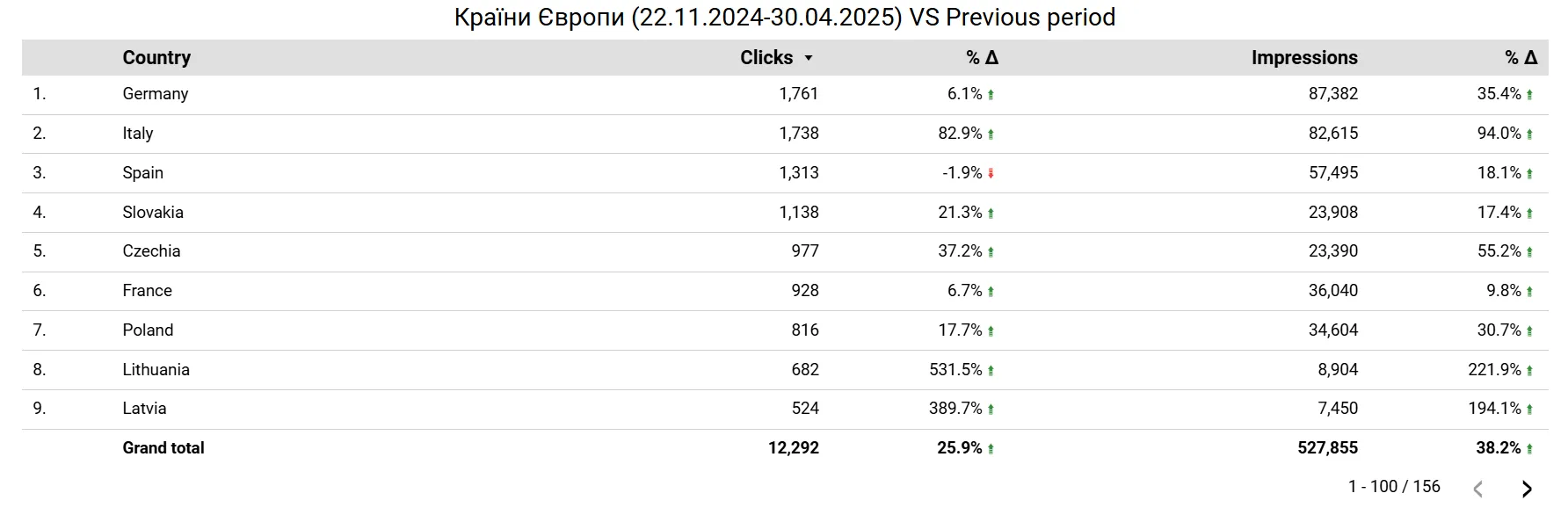

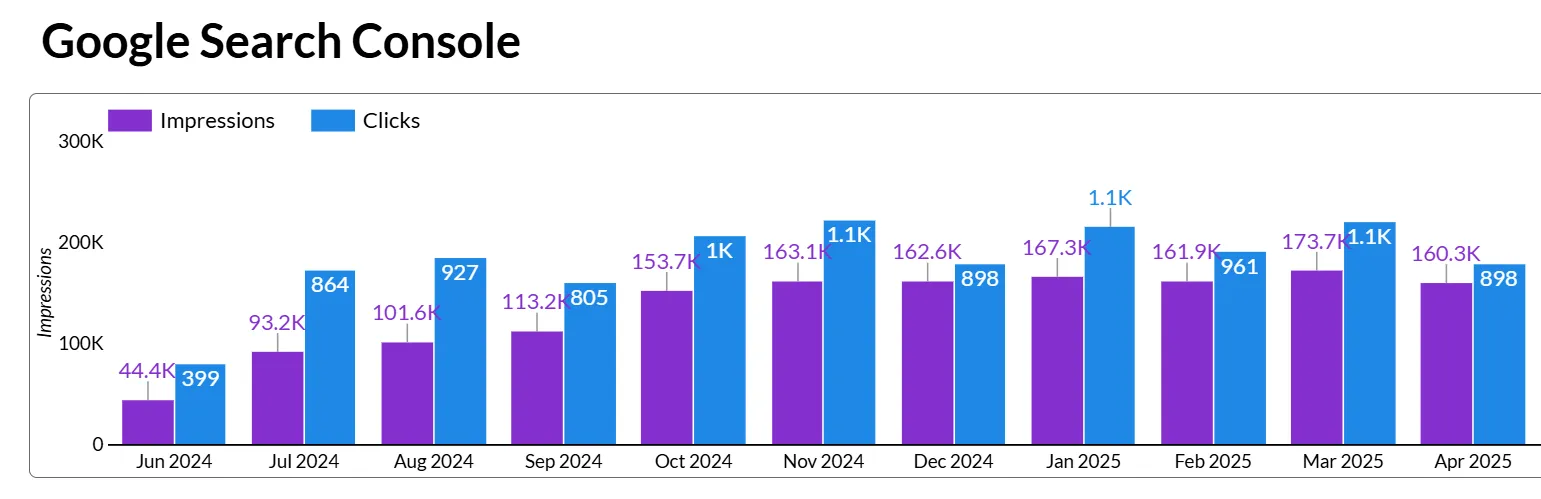

Over 21 months, we transformed a new EU market entrant from near-zero visibility into a steady performer in organic search. By April 2025, the site delivered 160K monthly impressions and around 900 clicks, peaking in March 2025 at 173.7K impressions and 1.1K clicks. Organic sessions increased 1,784% vs July 2023, with +407% revenue and +833% transactions from organic search. EU-focused execution drove +991% sessions and +279% revenue from European countries. Ahrefs-estimated organic traffic rose from 17 to 1,330 monthly visits - a 7,723% uplift.

We achieved this on a lean budget through a combination of technical SEO, multilingual content strategy, and link acquisition - all anchored in a clear hypothesis-led roadmap and verified by first-party analytics.

Client context

At kickoff in July 2023, the store was only three months into EU operations. The team lacked a competitor view, the site had critical technical issues, and initial content was limited to product pages. With EU documentation limiting catalog breadth, traditional commercial SEO alone would underperform. We needed to build authority and capture demand beyond the SKU footprint, without compromising technical quality or crawl efficiency.

Strategy

Our strategy followed three pillars that minimized risk and maximized compounding gains: technical foundations, multilingual content designed for intent, and steady link acquisition. With a constrained budget and limited SKU coverage, we shaped the plan around fast-indexing, long-tail capture, and regional relevance.

- Technical first - fix crawl waste, indexation, and duplicate content so every invested word and link compounds.

- Content to compensate SKU limits - emphasize an educational blog format with strong internal linking to collections and products. Use commercial framing within informational articles to convert.

- Multilingual expansion - localize core and informational content into key EU languages to grow non-English demand capture.

- Authority building - use a measured, white-hat link-building program to reinforce relevance and lift rankings.

Audience segmentation and personalization were built into the multilingual approach. By publishing localized content for German, French, Spanish, Italian, Polish and more, we increased perceived relevance and solved specific queries per market, which lifted click-through and conversion propensity.

Hypotheses we validated or designed for:

- Combined technical, content, and links drive the fastest cumulative lift for a new domain.

- Localized content would materially expand reach and revenue in EU markets vs English-only content.

- Information-led content with strong commercial pathways would outperform thin commercial pages given a narrow catalog.

- Late-2024 SERP intent shifts toward commercial required updating articles with product blocks and comparisons. We scoped redirects from some blog URLs to commercial pages, but these tests were not approved.

Tools used:

- Analytics - Google Analytics 4, Google Search Console, Seranking, Looker Studio, planned Google API connectors.

- Project management - Notion for task tracking and approvals.

- Link building - Collaborator for guest posts on relevant sites.

- Index support - selective services to maintain healthy crawl and index levels.

Execution

We ran the plan in iterative sprints that paired high-leverage technical fixes with compounding content and links.

- Technical SEO - full audit and recurring re-checks. Fixed pagination handling, corrected canonical URLs, and implemented redirects to consolidate duplicates. Monitored crawl budget signals, 500 errors, and page generation issues that intermittently surfaced on the stack. Coordinated developer fixes to maintain speed, index hygiene, and page quality.

- Content operations - built briefs and published optimized blog articles targeting long-tail informational intent closely tied to the product space. Embedded internal links to collections and products to create clear purchase paths from informational landing pages.

- Localization - translated and localized every article across 7+ European languages. This enabled "personalized" relevance at the market-language level and unlocked non-English demand capture.

- Link acquisition - executed consistent outreach and guest posts via Collaborator on relevant sites to strengthen domain authority and support priority clusters.

- Data transparency - instrumented tracking, created shared views in GA4, GSC, Seranking, and Looker Studio, and logged work artifacts in Notion for traceability and approvals. We used first-party data as the single source of truth for decision-making.

Example content types that performed well included practical, intent-aligned guides. Two representative topics were an ultimate guide to shampoos for damaged hair and a decision guide for choosing the right shampoo for hair extensions. Both targeted long-tail queries across European languages and integrated internal links to relevant collections to support conversion.

Results

Organic visibility and performance scaled from zero to reliable monthly volume. By April 2025, the site delivered 160.3K impressions and 898 clicks, with a March peak at 173.7K impressions and 1,106 clicks. Across the project window we observed:

- +1,784% sessions from organic search - April 2025 vs July 2023.

- +407% organic revenue and +833% organic transactions.

- +991% sessions and +279% revenue from European countries.

- +177% clicks from the July 2024 low point of 399 to 1,106 in March 2025.

- +304% sessions for July 2024 - April 2025 vs July 2023 - April 2024, despite limited approvals for proposed tests late-2024.

- +7,723% estimated monthly organic traffic per Ahrefs - from 17 to 1,330.

Year-over-year momentum held even as commercial pages softened after summer 2024. We offset that decline with blog improvements and targeted meta updates to improve CTR on product pages.

What changed and why it worked

We built a model tailored to a new domain in a competitive space with SKU constraints and tight budgets. The keys to success were clear hypotheses, compounding work, and tight feedback loops from first-party data.

- Problem - new domain with zero authority and duplicate index issues. Hypothesis - technical cleanup would unlock crawl and ranking potential. Action - fix pagination, canonicals, and redirects. Outcome - pages indexed cleanly, impressions and clicks began compounding.

- Problem - limited catalog reduces commercial keyword breadth. Hypothesis - an informational hub with strong internal commerce links can capture long-tail traffic and convert. Action - publish optimized guides across priority topics; link to collections and products. Outcome - large uplift in clicks and sessions, feeding assisted conversions.

- Problem - English-only scope misses most EU demand. Hypothesis - localized content will outperform translation-lite approaches. Action - translate and localize content to 7+ EU languages. Outcome - +991% EU sessions and +279% EU revenue from localized markets.

- Problem - mid-2024 SERPs tilted more commercial for some queries. Hypothesis - enhance articles with commercial blocks and improve product snippets. Action - updated content and meta for better CTR; planned blog-to-commercial redirects but approvals were not granted. Outcome - CTR lift on product pages helped offset commercial ranking softness; growth sustained at +301% YoY sessions.

- Problem - low domain authority initially constrained rankings. Hypothesis - consistent, relevant link acquisition would accelerate visibility. Action - guest posts via reputable platforms and ongoing outreach. Outcome - steady authority gains supported content ranking across languages.

- Problem - data fragmentation hinders decision-making. Hypothesis - centralizing GA4, GSC, Seranking, and Looker Studio views would increase speed and accuracy. Action - build shared reporting and track all work in Notion. Outcome - transparent iteration, faster approvals, and evidence-based prioritization.

Lessons and next steps

This program shows how to scale organic acquisition from zero in a competitive niche with a constrained catalog. The most transferable lessons:

- Foundations first - on a new domain, technical hygiene is non-negotiable. Crawl efficiency multiplies the ROI of every word and link.

- Content as the SKU multiplier - when catalog depth is limited, build intent-rich content that solves problems and steers readers to products. Internal linking is your conversion rail.

- Localization as personalization - market-language alignment is a decisive lever in the EU. Treat localization like product-market fit for content.

- On-SERP optimization matters - rich snippets, precise titles, and relevant meta can buoy performance when SERP intent shifts.

- Persistence over perfect approvals - even with delayed approvals on high-impact tests, disciplined execution on controllables can sustain +300% YoY growth.

Recommended next steps to extend growth:

- Test the deferred redirects - selectively route high-traffic informational URLs to commercial pages where SERP intent has clearly shifted, with tight measurement of CTR, conversion rate, and revenue per session.

- Scale structured data - extend product, FAQ, and article schema coverage to maximize eligibility for rich results and further improve CTR.

- Expand commercial depth - as EU documentation allows, broaden the catalog to support more commercial queries and improve conversion from informational paths.

- Double down on EU leaders - identify top-performing countries and languages and build deeper content clusters and local links around those markets.

- Conversion rate optimization - test on-page elements of the most visited articles and product pages to lift micro and macro conversions.

- Automation and connectors - operationalize Google API connectors for faster reporting, and consider programmatic SEO where applicable for long-tail variants.

With these steps, the site can build on a now-proven foundation to move from reliable to category-leading organic performance in the EU haircare niche.

.svg)