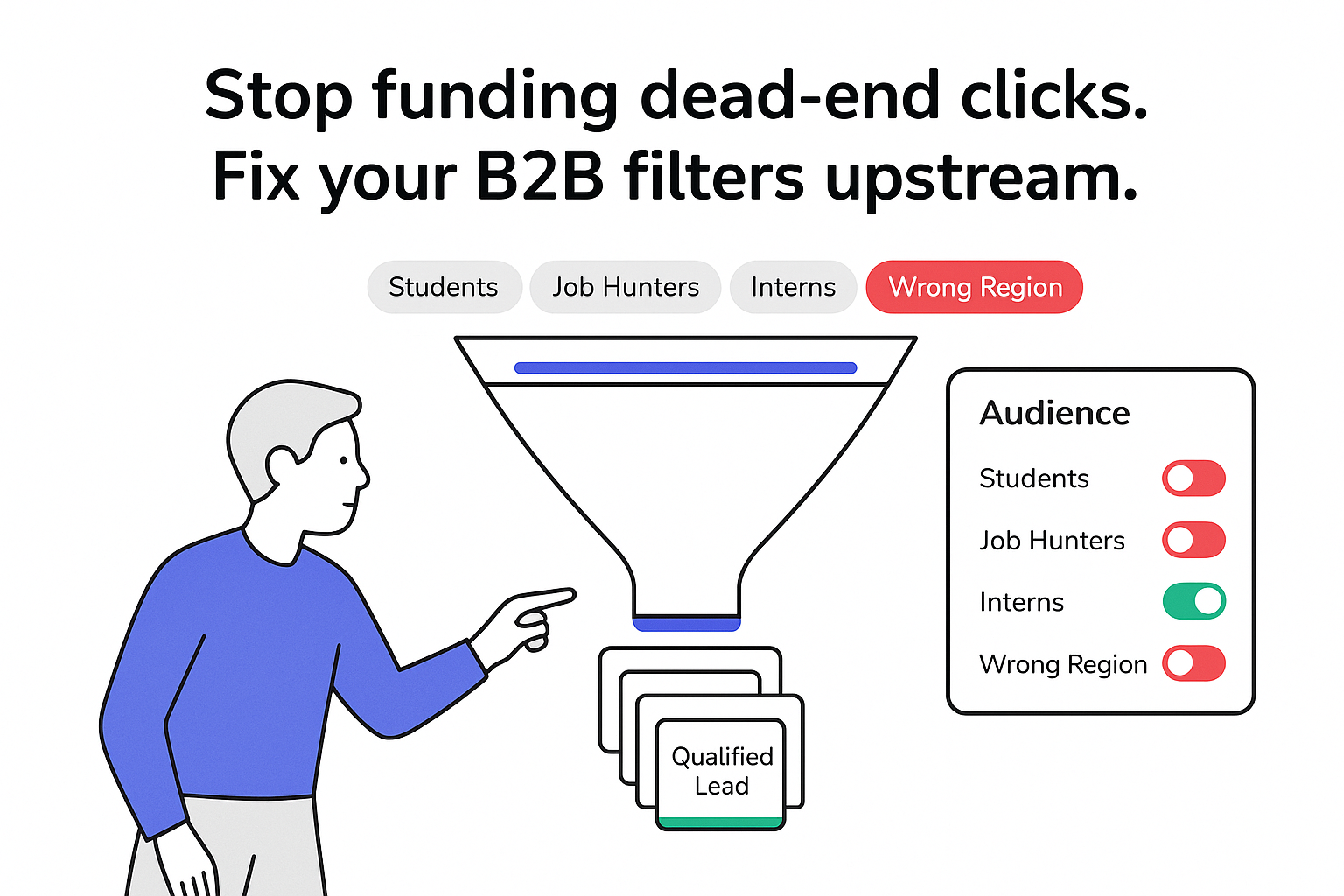

You can usually spot wasted Google Ads spend in a B2B service account within minutes: search terms full of “jobs,” “salary,” “free,” student queries, or clicks from regions you cannot even sell into. You end up paying for traffic that will never sign a contract. That inflates CAC, clogs your pipeline with low-intent leads, and makes paid search look weaker than it really is.

Negative keywords are the control lever that tells Google, “Don’t show my ads when this word (or intent) is present.” When you build them around B2B buying patterns - not generic lists - they cut junk traffic, lift conversion rate, and often lower CAC without changing bids, ads, or landing pages. (If you want a broader framework, see Negative keywords: the cheapest way to cut waste.)

What a B2B negative keyword list is (and what it isn’t)

A B2B negative keyword list is not about guessing every bad query in advance. It is about blocking predictable intent buckets that do not map to your sales motion: job seekers, students, DIYers, “free” hunters, consumers, or irrelevant geographies.

When the “filter” is weak, I typically see three consistent outcomes:

- A material share of spend going to people who can’t buy (or will never pass qualification)

- Sales time wasted on low-intent conversations (“just researching,” “send pricing,” “I’m a student”)

- The false conclusion that “Google Ads doesn’t work in our niche”

When the filter is strong, the same budget is simply pointed at more decision-maker searches. The biggest gains usually come from blocking obvious intent mismatches first, then tightening with real search-term data. If you are also fighting lead quality issues beyond intent, pair this with Reducing Spam Leads in B2B PPC Without Killing Volume.

Core categories to exclude (the structure that keeps this manageable)

Instead of maintaining a giant flat list, group negatives by intent so it is easy to expand and apply consistently across campaigns. This also aligns cleanly with a well-split account setup (see B2B Search Ads Account Structure: A Clean Split for Intent and Control).

| Category | Intent to exclude | Examples | Typical placement |

|---|---|---|---|

| Job seekers | Employment intent | jobs, careers, salary, internship | Account or shared list |

| Students / researchers | Information-only intent | definition, pdf, thesis, statistics | Shared list, sometimes campaign-level |

| Education / training | Course intent (unless you sell training) | course, certification, bootcamp | Account-level in most B2B services |

| Free / cheap | No-budget or price-only intent | free, cheap, coupon, open source | Shared list (use care in some niches) |

| DIY | “I’ll do it myself” intent | how to, template, tutorial | Often campaign or ad group |

| Consumer retail | Personal-use shopping intent | near me, store, amazon, for home | Campaign/ad group depending on offer |

| Brand safety | Adult/offensive intent | nsfw terms, explicit terms | Account-level |

| Unserved regions | Outside your coverage | countries/cities you don’t serve | Campaign-level + location settings |

Two guardrails I use: 1) Only exclude a category at account level when you are confident it never overlaps with qualified demand. 2) Treat geography negatives as a coverage decision (serviceability, language, legal constraints), not as a blanket assumption about “good” or “bad” regions. For deeper geo strategy, see Geo targeting: how tight should your ads go?.

Universal starter negatives (good defaults for most B2B services)

These are “workhorse” negatives I commonly start with, then adjust based on your search terms report and what your sales team calls “junk.” If you want the full set in a structured format, Get a downloadable spreadsheet of these negative keywords >>.

Job-seeker intent (starter block)

job, jobs, hiring, careers, career, employment, vacancy, recruiter, recruitment, staffing,

internship, intern, entry level, trainee, resume, cv, cover letter, apply, application,

salary, salaries, wage, wages, hourly, benefitsResearch / reference intent (starter block)

definition, meaning, what is, examples, pdf, ppt, powerpoint, slides,

thesis, dissertation, research paper, white paper, whitepaper, report,

statistics, dataset, wiki, wikipedia, journalEducation / training intent (starter block)

course, courses, class, classes, training, certification, certificate, diploma, degree,

bootcamp, workshop, seminar, lesson, syllabus, curriculum, exam, practice testFree / low-budget intent (starter block)

free, no cost, cheap, cheapest, low cost, discount, coupon, voucher, deal, promo code,

trial, free trial, open source, freewareDIY intent (starter block)

diy, do it yourself, how to, tutorial, guide, template, sample, walkthrough,

instructions, build your own, create your ownConsumer / retail intent (starter block)

near me, nearby, for home, personal use, store, shop, amazon, ebay, marketplace, retailBrand safety (example approach)

I keep this at account level and aligned with brand standards. I avoid listing slurs or explicit variations in documentation, but the goal is simple: prevent ads from showing against adult or offensive intent.

Unserved geographies

Instead of copying a generic country list, build this from the reality of coverage - where you can sell, onboard, and support. I usually rely first on location targeting/exclusions, then use negative keywords only when location intent still leaks into queries (for example, “in [country/city]” searches).

B2B service-specific negatives (where most generic lists fall short)

B2B services often get “almost relevant” searches that still will not convert because the role, company size, or intent is wrong. I look for patterns like these:

Career-path and “how to become” intent

how to become, career path, job description, responsibilities, duties, salary range, salary guideFreelancer marketplaces and side-gig intent

upwork, fiverr, freelancer, freelance jobs, gig, side hustle, part time gigVery small/consumer framing (only if you don’t serve it)

for individuals, for personal use, small home business, home project, hobbyOne nuance: I do not automatically exclude “small business” language in B2B. In many industries, “small business” can still mean a legitimate buyer. I only exclude it when I am intentionally mid-market/enterprise only and sales data confirms those clicks do not qualify.

If you’re premium-positioned: filtering price shoppers without breaking demand

If you sell a premium service, “cheap” and “free” searches often create the worst time sink: long conversations that never close. Negative keywords can reduce that before the click.

Price-shopping intent (starter block)

cheap, cheapest, low cost, low price, discount, coupon, promo code, deal, bargain,

price list, price per hour, hourly rate, compare prices, lowest priceI am careful here because price language is not always bad. Some qualified buyers search for pricing because they are ready to shortlist vendors. What I exclude first are the strongest “I want the cheapest option” signals (cheap/cheapest/coupon) and the strongest “I want it free” signals.

This is also where lead volume can drop. That is not automatically a problem. If qualification rate rises and CAC improves, fewer leads can still mean more pipeline. I do not judge the change by form fills alone - I judge it by qualified lead rate and downstream opportunity creation. To make Smart Bidding reflect that reality, connect lead quality to optimization (see Offline Conversion Imports: The Only Signals Google Ads Should Optimize For).

On “how many negatives is too many”: there is no magic number. I have seen healthy accounts with hundreds of negatives and others with thousands. The only “too many” is when broad negatives start blocking real buyer intent.

Industry tuning (add-ons that depend on what you sell)

Use universal negatives as the base, then layer in a small set of industry add-ons based on what actually shows up in the search terms report.

B2B tech / SaaS services (implementation, managed services, platforms)

crack, serial key, license key, torrent, github, source code, stack overflow,

error code, error message, how to install, system requirementsMarketing services

marketing jobs, digital marketing course, seo course, google ads course,

free marketing plan template, marketing proposal template, content calendar templateProfessional services (legal/accounting/consulting selling to businesses)

free legal advice, personal injury, speeding ticket, divorce,

tax help for individuals, cpa exam, bookkeeping course, law schoolLogistics / transportation (B2B freight, logistics consulting)

truck driver jobs, cdl training, uber, lyft, bus ticket, flight ticket,

vacation package, moving truck rentalI keep these lists intentionally short at first. If you add 200 industry negatives on day one, you increase the risk of blocking a profitable edge case you did not anticipate.

Match types and where to apply negatives (so you don’t block good traffic)

Negative match types control how strictly Google blocks queries.

| Negative type | Example | What it blocks | When I use it |

|---|---|---|---|

| Exact | [it support jobs] |

Very close variants of that query | One specific “bad actor” query |

| Phrase | "it support jobs" |

Queries containing that phrase in that order | Common junk phrasing (jobs, free trials, etc.) |

| Broad | jobs |

Queries containing that term and close variants | Universal intent blocks - only when safe |

Placement matters just as much as match type:

- Account/shared lists for universal intent (jobs, explicit content, core “free” terms).

- Campaign level for geography and campaign-specific intent differences.

- Ad group level when you need to route traffic between similar services (so one ad group does not cannibalize another).

Competitor names are a strategic choice, not a default. If you never want competitor traffic, exclude competitor brands to prevent broad match from drifting. If you do want competitor comparisons, isolate that behavior into a dedicated campaign so it does not pollute core performance reporting.

If you also run Display or YouTube, you will want separate controls for placements and apps. For that, use our display network list.

Maintaining and measuring negatives (without living in search-term reports)

The best negative keyword list is never “done,” but it also should not require daily micromanagement. What works in practice is a light cadence tied to spend and change.

My maintenance rhythm

- New or recently restructured campaigns: review search terms weekly for a few weeks.

- Stable campaigns: review monthly, and additionally after new services, new geographies, or major keyword expansions.

When I add negatives, I add them as themes (phrase patterns) whenever possible, not as one-off whack-a-mole entries. I also avoid rushing into broad negatives at the account level until I am confident the word does not appear in converting queries.

How I measure whether negatives are helping

I look for movement in a small set of indicators:

- Share of spend going to clearly irrelevant intent (before vs. after)

- Cost per qualified lead (not just cost per lead)

- Conversion rate and lead quality notes from sales

- CTR and relevance signals over time (often improves when intent tightens)

If performance drops after a negative update, I assume I over-blocked and roll back the last change set. Negative keywords are powerful precisely because they can remove volume - so treat every broad exclusion as “measure twice, cut once.”

.svg)